Our Talent development process

We seek to develop Oxford’s budding investors and are open to all students at the University of Oxford. Our process involves multiple stages. Keen but inexperienced students are brought on board via our bootcamp. Once they join us as analysts, they work under a team led by more senior analysts and portfolio managers. At the end of every term in which research is conducted, we hold a stock pitch day with industry veterans where our teams gain valuable feedback and refine their processes. Our team members grow by conducting hands-on investment research in conjunction with a directed, rigorous course of self-study. At the same time, we host training programmes and industry events held in conjunction with our research partners.

BootCamp

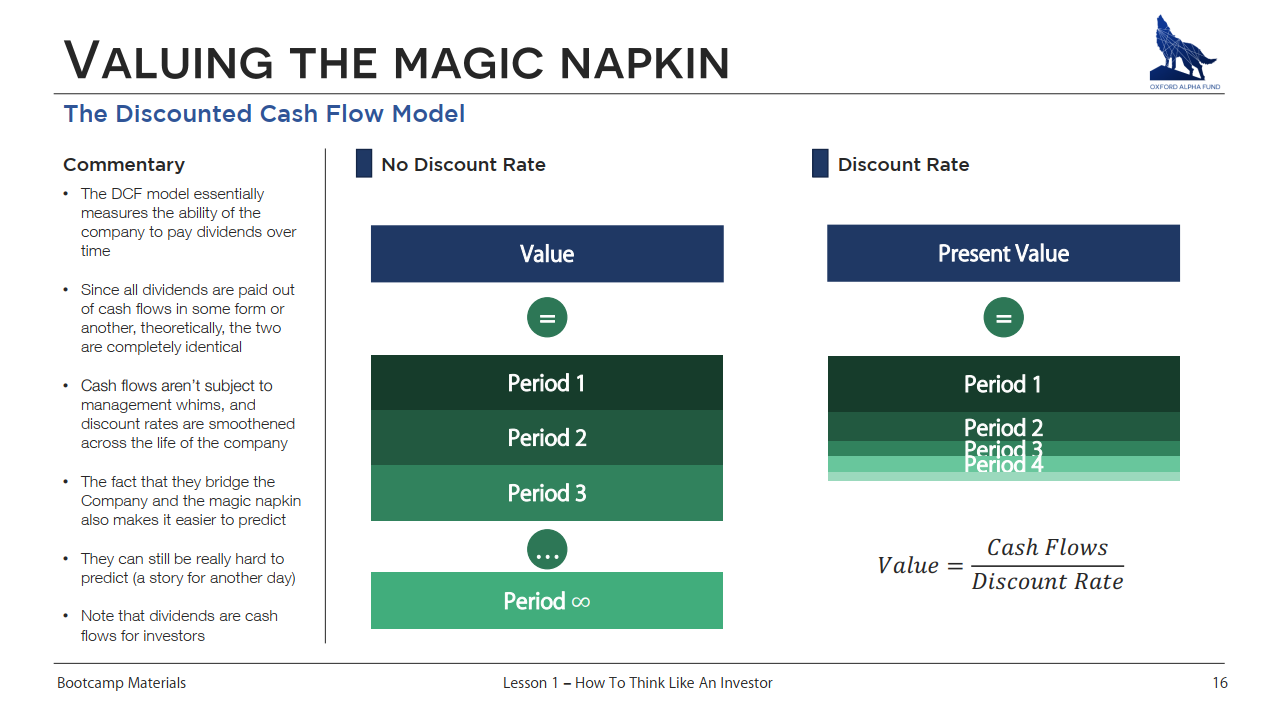

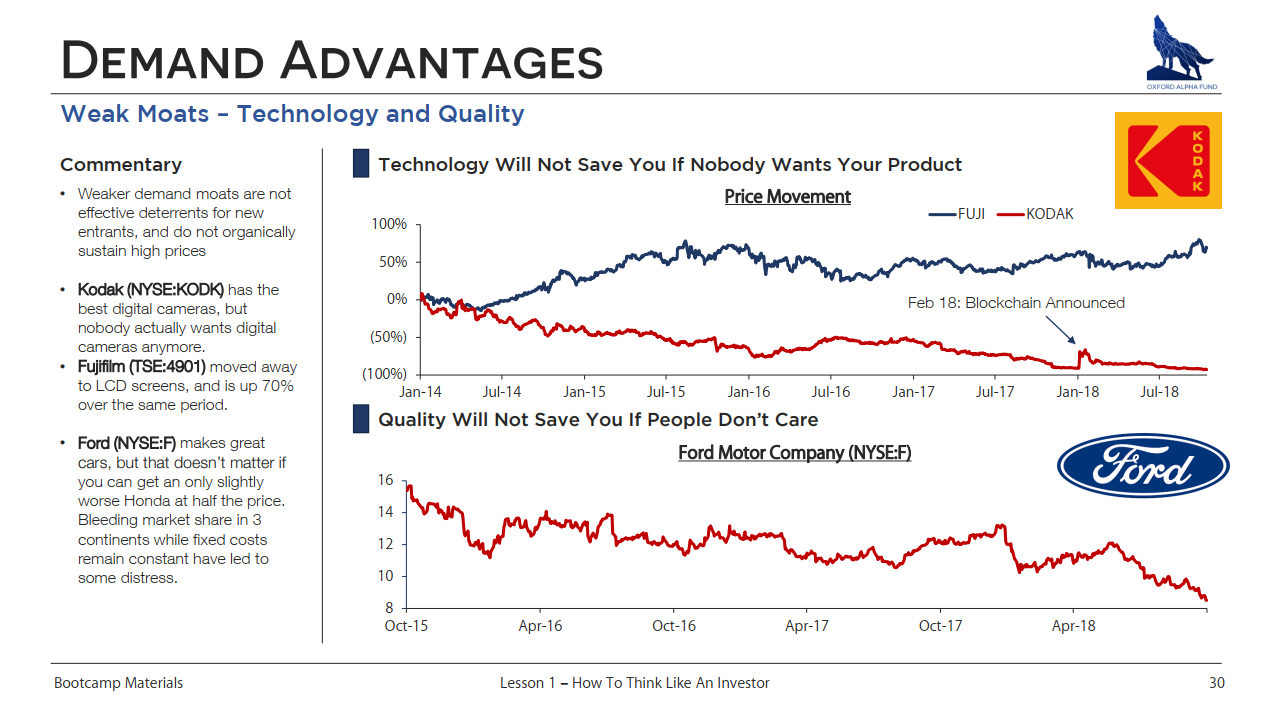

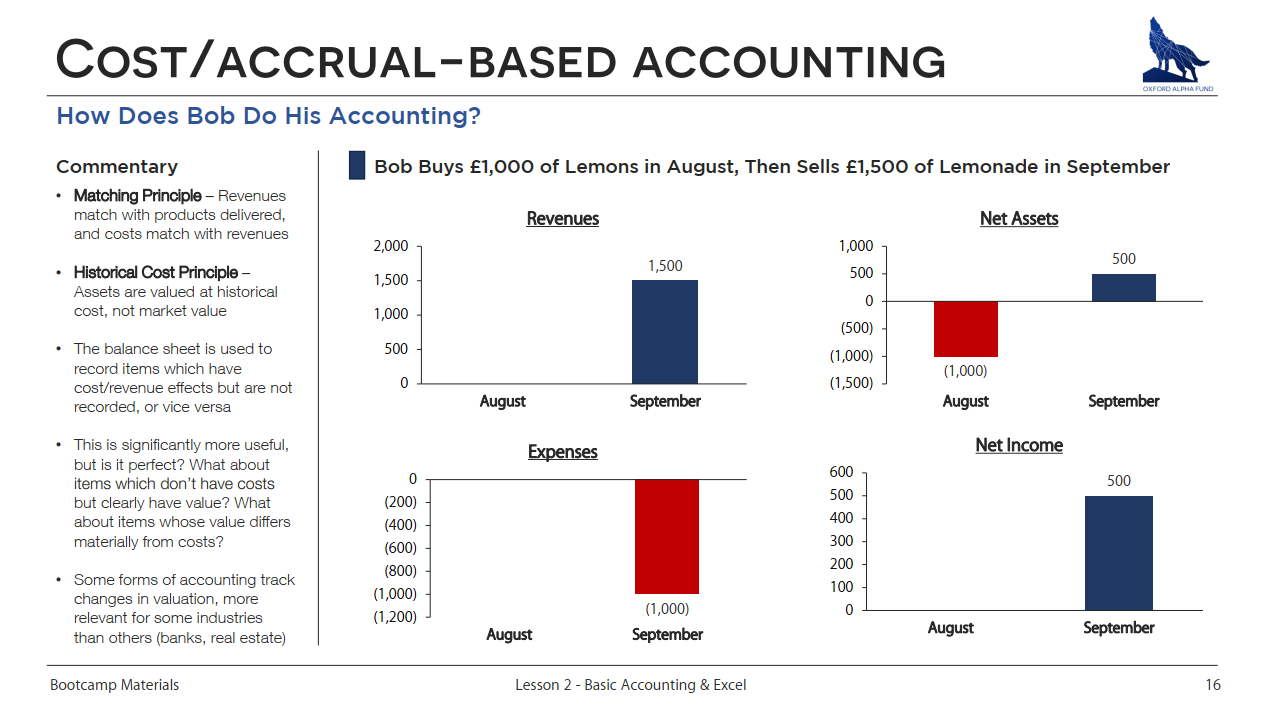

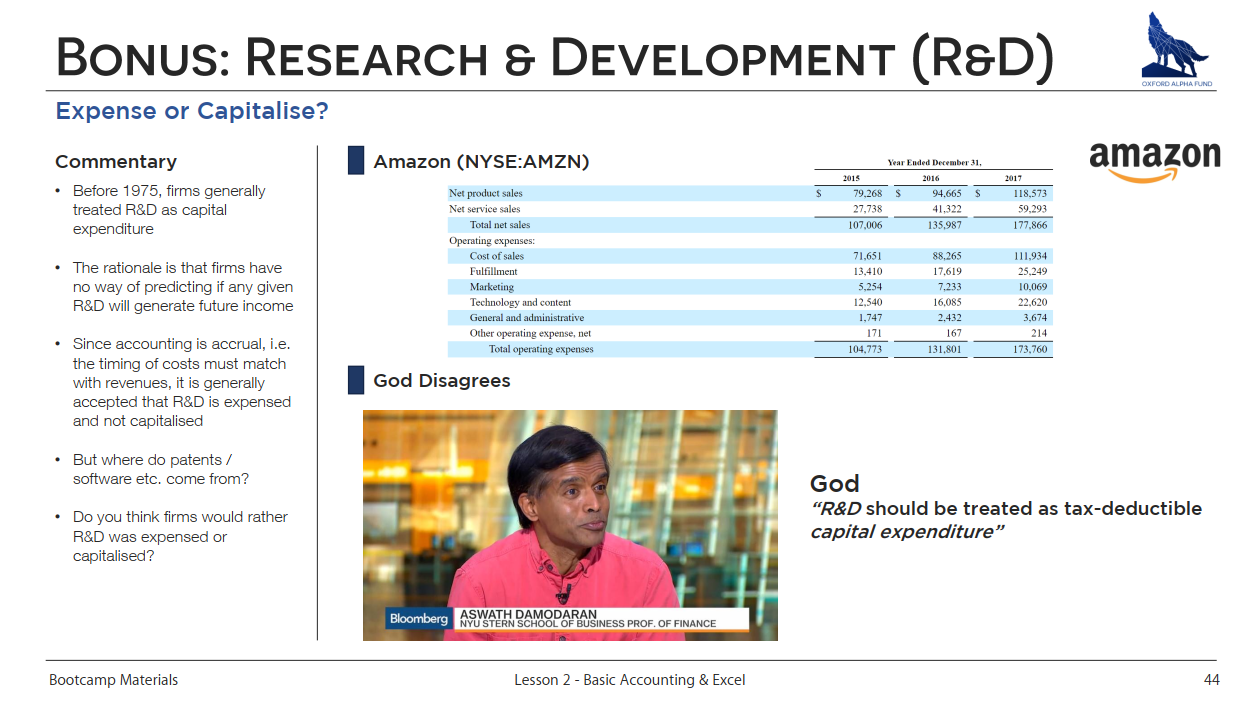

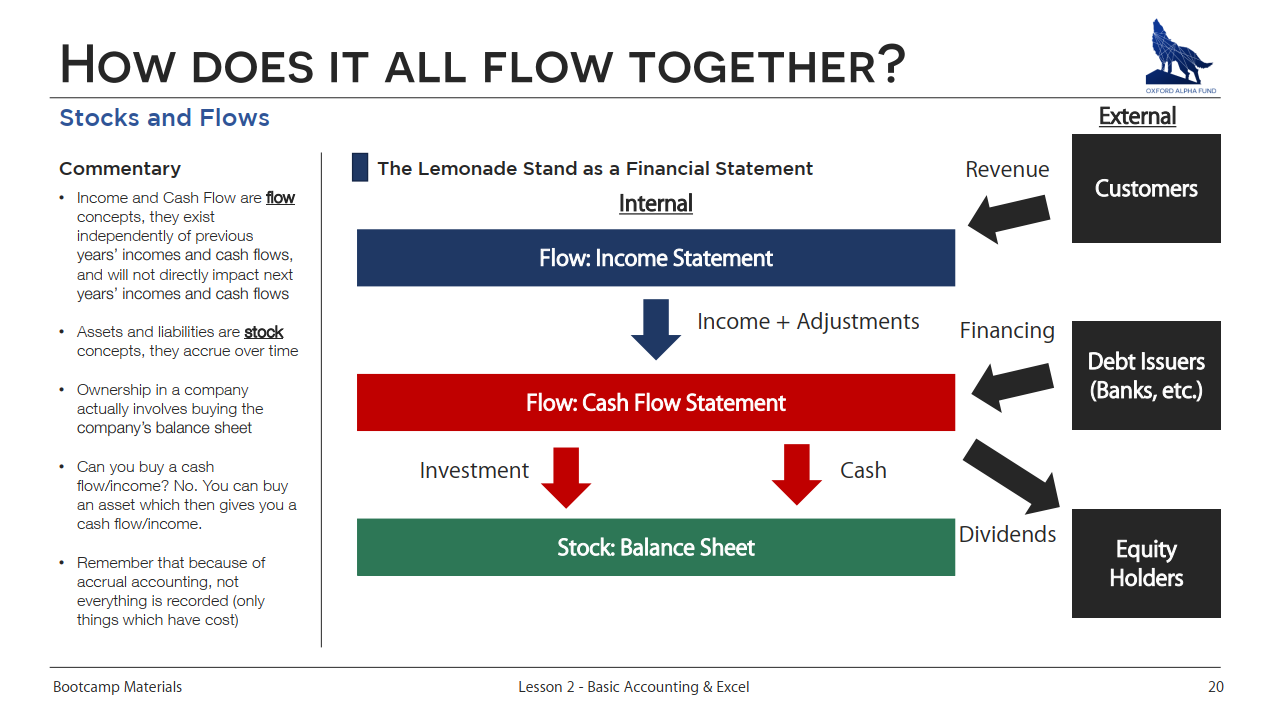

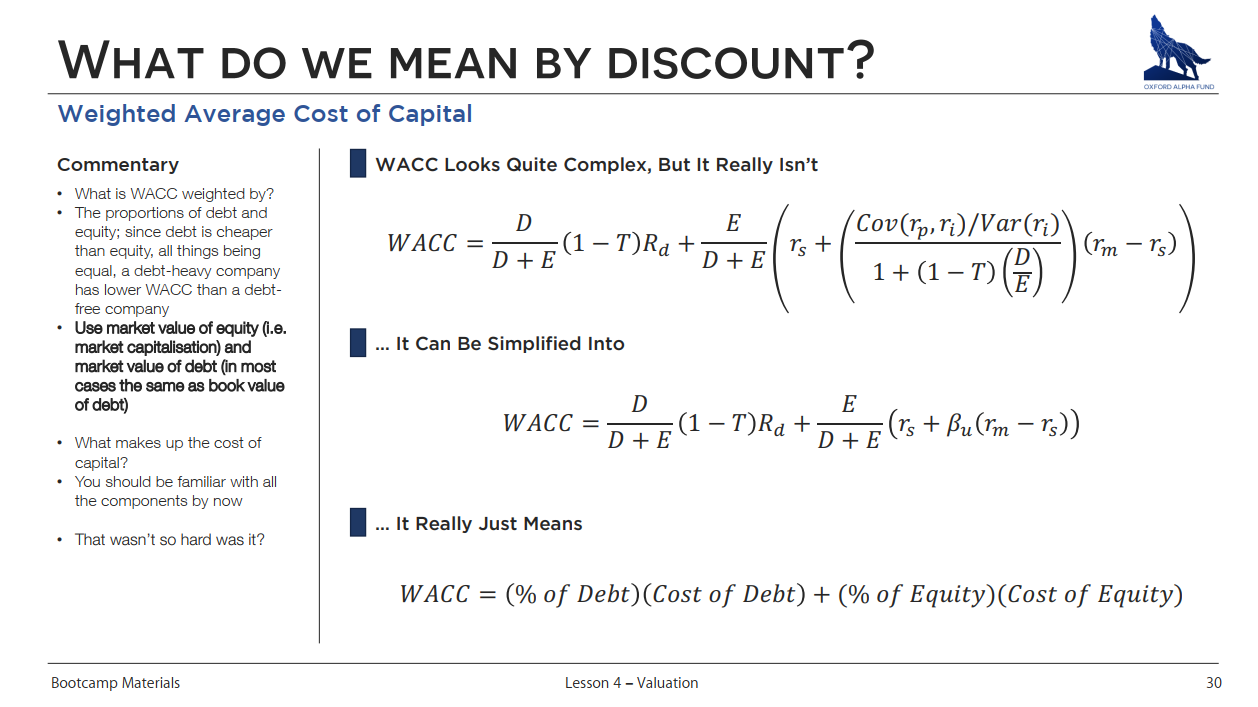

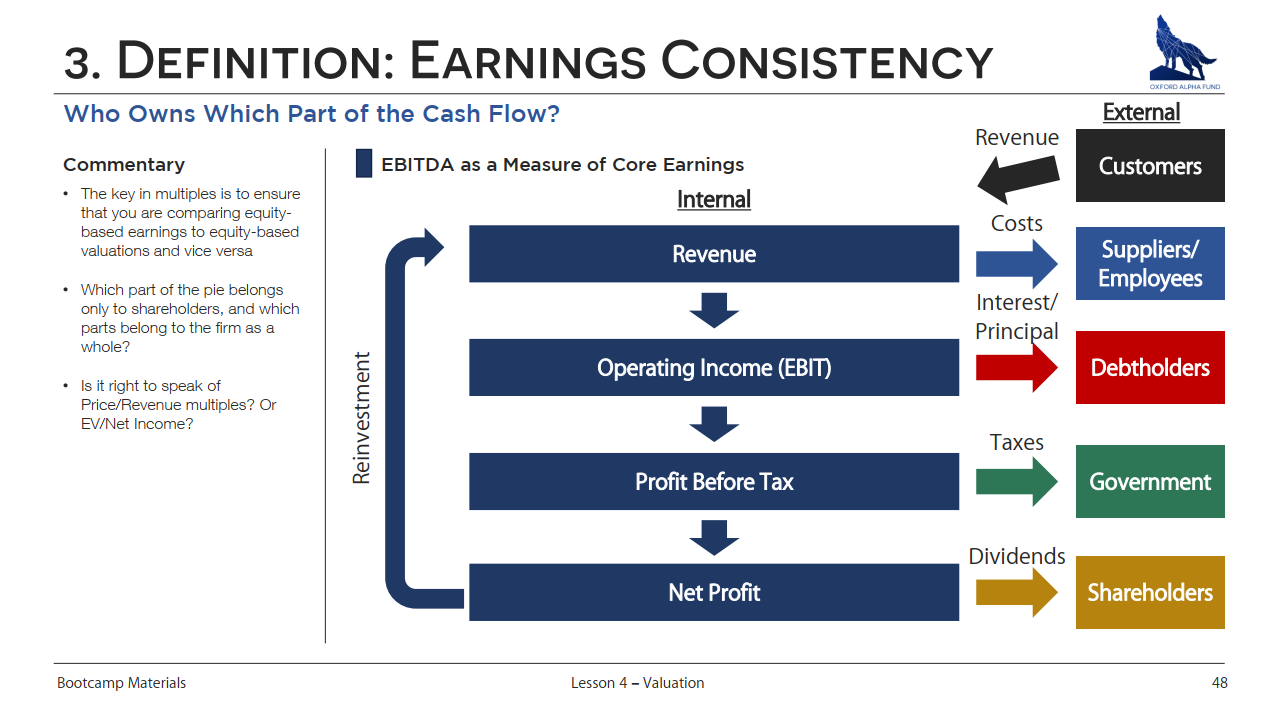

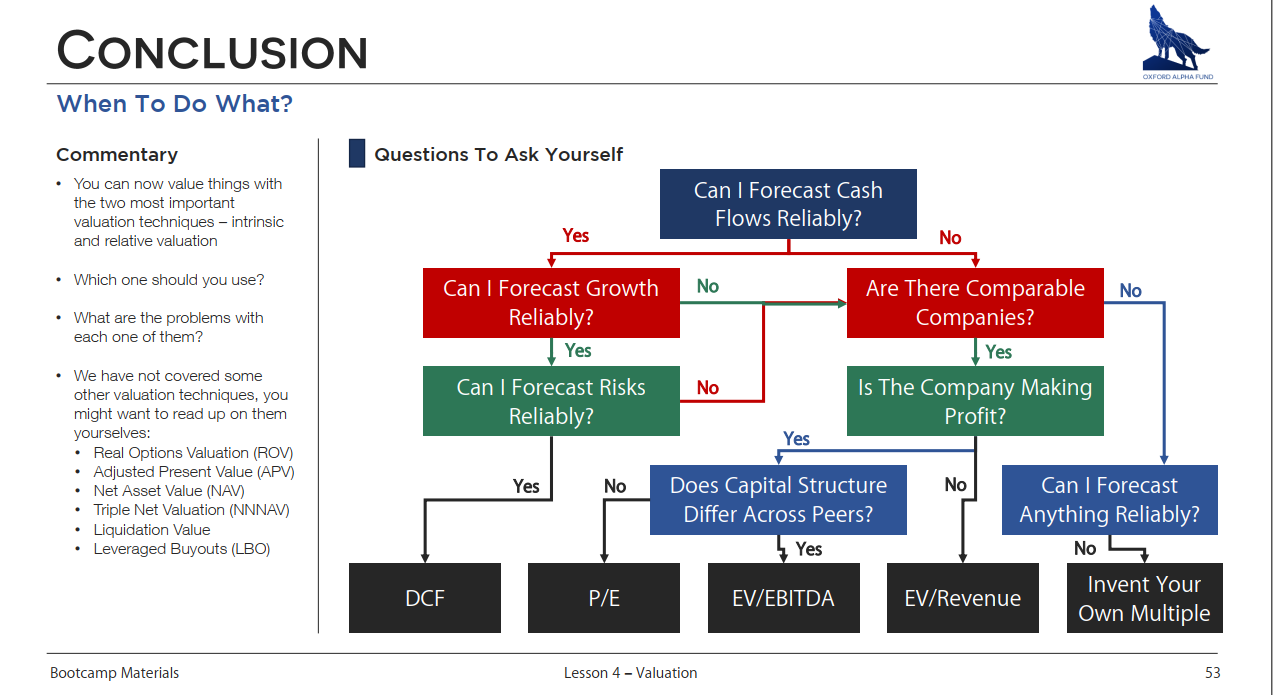

We hold our bootcamps in Michaelmas term each year. Highly interested and committed candidates are given a 6 week-long crash course in accounting, foundational modelling, and financial analysis by experienced portfolio managers within the fund and alumni instructors at leading asset managers and investment banks, in conjunction with our research partners. In Michaelmas term, this culminates in a team case competition presented to a panel of our Portfolio Managers. In MT’18, 15 of our 30 trainees graduated into our analyst class. See the winning pitch from out MT’18 Bootcamp here. Some sample slides from our bootcamp material are shown below.

Termly Cycle

Our termly cycle exists in order to provide students the chance to practice and apply investment research and financial modelling skills over the course of an Oxford term. We recognise that becoming a better investor is a lifelong process, and requires working towards developing whole host of complex skills - everything from understanding business models to accounting, financial analysis, and valuation. We thus do not expect our analysts to get everything at once. What matters is a persistent and systematic approach to growing as an investor. Taking our bootcamp as a foundational stepping stone, we developed our termly framework into one that brings students through the life-cycle of an investment idea. At each stage we provide reference texts for the requisite skills, with the idea that as our analysts go through our processes over multiple cycles, they gain competence and confidence as investors.